Knowing how to budget for a wedding is seriously important for engaged couples planning their big day. After a few years of the pandemic turning the wedding industry upside down, 2023 has brought some blessed normalcy—but everyone is still feeling the lingering effects

A study from earlier this year found that more than 60% of couples say the economy has made an impact on their wedding planning, and 30% say that they’re changing their budget as a result. Plus, almost half of couples say they’ve gone over their planned budget by an average of $7300—not exactly pocket change.

In other words: Planning a wedding budget (and sticking to it) is no walk in the park for couples getting married in the near future. But it’s still possible with smart planning and a little flexibility, and in this article we’ll tell you exactly how to do it.

Read on for the Perennial guide to making your wedding budget, including a deep dive on why a structured budget is a must (a MUST!) and a 5-step process for building yours.

Quick Takeaways:

- Knowing how to budget for a wedding helps you stay in control of your finances, minimize stress, and plan a wedding day you’ll love within your financial means.

- The first key steps to wedding budgeting are to nail down your total budget, then list your personal priorities.

- Two pro tips to stay organized are to maintain your budget in a spreadsheet and stay flexible by planning for contingency funds.

Why Is Your Wedding Budget So Important?

A wedding budget is crucial for several reasons. First and foremost, it helps you maintain control over your finances and avoid overspending. Weddings can quickly become expensive, and without a budget, costs can spiral out of control, leading to unnecessary stress and unexpected debt. But these problems can be avoided.

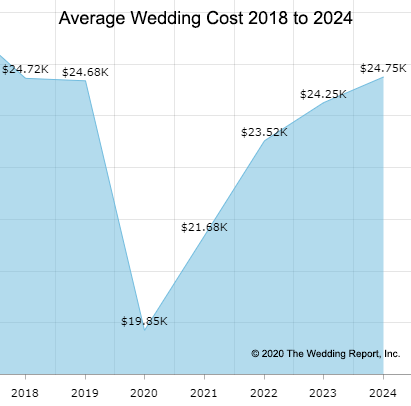

On average, couples are spending about $24,000 on their wedding. It’s a huge investment! And it’s a lot to keep track of. Doing so requires careful budgeting and saving during the months you spend planning.

Knowing how to budget for a wedding also has a number of other benefits, including:

- Helping you prioritize budget items and allocate resources

- Enabling you to save more intentionally and successfully

- Keeping your planning organized and avoiding unwelcome surprises

- Helping you plan non-wedding financial commitments effectively

- Facilitating better communication between you and your significant other

- Keeping you disciplined to plan a wedding within your means

That last one? It’s one of the most important. So many couples have the false idea that in order to have the best wedding possible, you need to spend more, more, more. But the opposite is true! We see couples plan small weddings on a budget that are just as beautiful and memorable as those held in extravagant venues with huge guest lists.

Ultimately, a wedding budget empowers you to make informed choices, maintain financial stability, and enjoy your special day without unnecessary financial stress. It allows you to focus on creating beautiful memories rather than worrying about the financial aftermath.

Let’s walk through 5 steps for how to do it.

How to Budget For a Wedding: 5 Simple Steps

Set Your Overall Budget

First thing’s first: What’s the total amount you can and want to spend on your wedding? Don’t wait for individual expenses to pile up and dictate where your total ends up—make the decision about your total first, then fit your expenses into that amount.

Where your total lands depends on your current financial situation and future expenses that are upcoming in the future. Evaluate these factors as completely as possible. Consider your current earnings, savings, and living expenses, as well as things you’ll pay for in the future.

If you already own a home, for example, you might be able to spend more than if you’re purchasing one during your engagement. If you have significant savings built up, you can likely spend more than if you’re just starting to save right now.

You also might have personal preferences about how much you should spend on your wedding. Even if you have the financial means to have a big wedding, you might prefer to keep your budget smaller and save for other future expenses. Of note, you should consider the size of your wedding guest list during this step, as it largely dictates the range where your budget will fall.

List Your Priorities

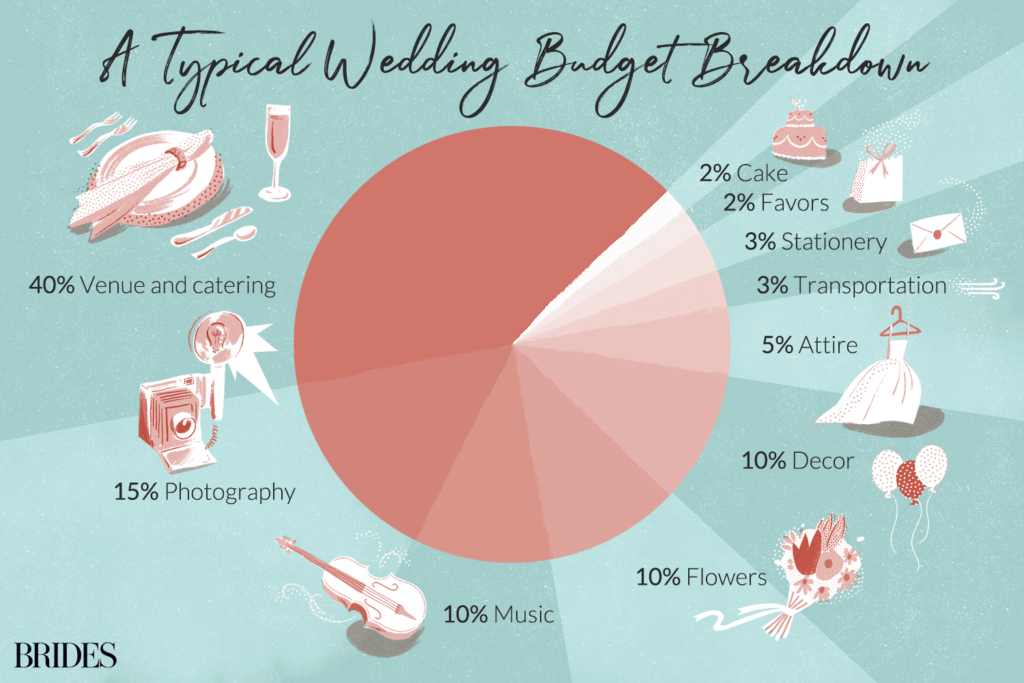

Next, start thinking about your unique wedding priorities. Start big and (usually venue and guest list) and work your way to smaller expenses as you go. List items in order of importance, then think about how much you want to spend on each. Below is a list of common wedding expenses and the average budget percentage of each to give you a framework to start with.

Research and Estimate Costs

Once you have your planned budget and ideal breakdown set, it’s time to do your research on potential vendors. There are plenty of free resources you can use for your research, including searchable vendor review databases (like this one hosted by WeddingWire) as well as trusty old Google (search for the type of vendor + the name of the area where you live).

Get an idea of average pricing for each, and make a list of vendors you might want to hire and that are in your price range. It’s usually at this step where couples start to slightly adjust their budget in places—if you have your heart set on a certain venue or photographer, for example, you might increase your budget in those areas and squeeze it elsewhere to compensate.

Once you have your planned budget and ideal breakdown set, it’s time to do your research on potential vendors. There are plenty of free resources you can use for your research, including searchable vendor review databases (like this one hosted by WeddingWire) as well as trusty old Google (search for the type of vendor + the name of the area where you live).

Build a Spreadsheet

Remember when we said your budget must (MUST!) be structured? We totally meant that. Don’t make the mistake of keeping your budget in a casual iPhone note or a list hanging on the fridge. Instead, build a spreadsheet that includes an itemized list of planned and actual expenses as well as extras that pop up along the way (they’re inevitable).

We recommend Google Sheets as an easy, shareable solution—you and your significant other can both make and see budget updates in real time, plus the document will always autosave, so there’s never any confusion.

Leave Room for Contingency Funds

Last but not least, leave a little room in your budget for contingencies—those unexpected items we mentioned before that pop up unexpectedly. No matter how well you plan, you’ll encounter some of these along the way. When you leave wiggle room in your budget, they don’t have to be a source of stress.

Final Tips

Perfect, beautiful weddings are possible at every budget. The most important takeaway from thinking about how to budget for a wedding is not to feel pressured by a particular number or type of wedding because you think that’s what you should do.

The only way to be sure you have no regrets about your wedding budget (and your actual wedding day) is to be realistic and organized when it comes to your budget using the tips we’ve covered in this guide, and to always go with your gut and do what’s right for you.

Let Perennial Bring Your Wedding Day to Life

At Perennial, we’re dedicated to documenting your unique story, capturing moments in their truest form and bringing out genuine laughter along the way. On your wedding day, all you have to do is just be you, and we’ll take care of the rest.

We offer several packages (including customized a-la-carte options) and flexible payment plans so investing in your wedding photography never has to be a financial burden.

Book a discovery call with us to learn more!